FOR IMMEDIATE RELEASE

Nationwide revenue cycle solutions provider helps hospitals navigate the complexities of clinical revenue cycle management.

Tampa, Fla. – [November 17, 2025]

Hospitals received a brief reprieve from Aetna’s Level of Severity Inpatient Policy that applies to their Medicare Advantage (MA) products for provider contracts paid on Diagnosis Related Groups (DRGs) and Medicare Allowable payment methodologies. The implementation date has been moved to January 1, 2026, from November 15, 2025. This is not the update the hospital industry was hoping for as opposition to this policy has been submitted to the Centers for Medicare and Medicaid (CMS) as well as top administration officials.

Aetna’s Level of Severity Payment Policy

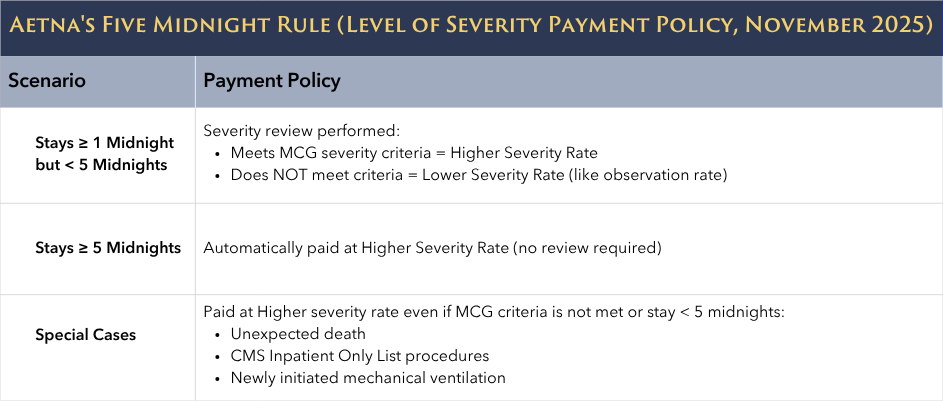

Under this new policy, Aetna is unilaterally imposing a Five Midnight Rule for contracted providers. Urgent and emergent hospital stays of one (1) midnight and greater with a valid inpatient admission order will be authorized as an inpatient admission; however, some claims may be paid at a reduced rate. This is in direct conflict with the Medicare Two-Midnight Rule that uses a two-midnight threshold to support inpatient admissions. Additionally, severity is already considered within the inpatient payment methodology for traditional Medicare beneficiaries due to the nature of the Medicare Severity Diagnosis Related Group (MS-DRG) methodology where additional payments are made for patients with diagnoses classified as complications/comorbidities (CCs) or major complications/comorbidities (MCCs).

Brundage Group’s Perspective

Aetna’s unilateral decision to implement a Five-Midnight Rule could have significant financial consequences for hospitals. A rate similar to what is paid for observation services is unlikely to cover hospital expenses associated with an inpatient visit that crosses two or more midnights. MA organizations are reimbursed annually based on the expected resources needed to treat a beneficiary as determined by a variety of factors including billed diagnoses that map to CMS Hierarchical Condition Categories (HCC). CMS may need to restructure their MA payment methods to reflect Aetna’s lower inpatient cost under this new strategy. This marks a major shift from the current reimbursement structure, increasing hospitals’ risk of revenue loss amid the challenges of the “One Big Beautiful Bill.”

Medicare Regulations Applicable to Medicare Advantage (MA) Plans

Aetna has made the calculation that referring to this as a “payment policy” will allow them to implement coverage criteria more restrictive than what is allowable under traditional Medicare. Aetna claims their policy is compliant because “while CMS regulates inpatient coverage determinations, it does not dictate payment terms for contracted providers.” Although this statement appears in federal regulations, it is taken out of context and is being misinterpreted by Aetna.

Key excerpts from the Contract Year 2024 Medicare Program Update and other federal regulations that demonstrate Aetna’s Five Midnight Rule violates federal regulations.

- When determining if Traditional Medicare criteria apply in MA, it is irrelevant whether they are classified as coverage or payment rules, both address the scope of items and services for which benefits are available under Parts A and B.

- As finalized in § 422.101(b)(2), MA plans must comply with general coverage and benefit conditions included in Traditional Medicare laws, unless superseded by laws applicable to MA plans.

- “This includes criteria for determining whether an item or service is a benefit available under Traditional Medicare, such as payment criteria for inpatient admissions at 42 CFR 412.3”

- “Services and procedures that the Secretary designates as requiring inpatient care under 42 CFR 419.22(n)”

- “MA plans may not use InterQual or MCG criteria, or similar products, to change coverage or payment criteria already established under Traditional Medicare laws.”

- We [CMS] acknowledge that 412.3 is a payment rule for Medicare FFS, however, providing payment for an item or service is one way that MA organizations provide coverage for benefits.

- CMS plans to codify existing policy at § 422.101(c)(1)(i)(C) that MA organizations consider the enrollee’s medical history (for example, diagnoses, conditions, functional status), physician recommendations, and clinical notes.

Appeal Rights under Aetna’s Five Midnight Rule

Under the new process hospitals submit clinical information within 24 hours of notification. Aetna will perform an initial severity review, “the payment level (high or low level of severity) is based on the number of days the patient is in the hospital and not on the days authorized.” Providers will receive written notification of the inpatient authorization for 7 days and the severity decision.

The new policy does not allow “peer to peer” reviews since they are not issuing an inpatient authorization denial for these claims. Instead, if a hospital disagrees with the severity determination they can:

- Request (via fax) within 7 business days of the date of the decision notification and before the claim is submitted that Aetna review the case again with additional supporting clinical information.

- Request (by phone) a severity discussion with a medical director within 14 calendar days from the date of the decision and before the claim has been submitted.

- Claims impacted by the severity payment policy will receive the following electronic remittance advice from Aetna: Payment based on an appropriate level of care. After the claim is paid, hospitals retain their contractual right to dispute the level of payment.

Next Steps

Hospitals and health systems must continue challenging MA plans like Aetna that attempt to unilaterally redefine federal reimbursement methods. Aetna’s policy exemplifies how MA plans seek to bypass Medicare regulations, underscoring the need for vigilance against payors imposing payment requirements inconsistent with federal rules.

Aetna claims their contracts allow them to “introduce and implement payment policies,” and that “providers agree to comply with policies that Aetna may implement from time to time.” Hospitals should review their Aetna contracts, as this may create individual legal considerations unless federal guidance clarifies the issue.

Brundage Group will continue to monitor developments and advocate for hospitals and patients.

Please reach out if you’d like to discuss strategies specific to your organization.